News

Overcoming Barriers to Automation Investment: The First Step is the Hardest

The Hesitation Behind the Opportunity

Automation offers significant benefits such as faster throughput, reduced labour costs, improved accuracy, and scalable growth, especially for sectors like warehouse and manufacturing.

However, many businesses hesitate to adopt automation due to the high capital expenditure, delivery and integration risks, including potential disruption to business operations. The stakes of getting automation wrong can be high, particularly for companies operating on tight margins or who are under investment scrutiny.

This article discusses the challenges of automation adoption, the risks of mistakes, and presents accessible, phased, and financially flexible strategies to mitigate these risks.

The Risks of Getting Automation Wrong

While automation is widely seen as a strategic enabler, it is not without its pitfalls, particularly when approached without sufficient planning, budget discipline, or organisational alignment.

- Financial risk: Poorly planned automation can lead to underused or incompatible systems, tying up capital and delivering weak returns

- Operational disruption: Without a clear understanding of existing workflows, automation may unintentionally reduce efficiency or output

- Reputational harm: Failed rollouts can cause missed deadlines, quality issues, and internal disruption, damaging trust and morale

- Integration challenges: Automation must work smoothly with legacy systems; if not, it can create data issues and inconsistent performance

- Future processes and detailed design: Automation is typically built around specific, predefined processes, which can limit flexibility if operational needs evolve or processes change over time

De-risking the Journey: Practical Solutions

When companies are faced with capital constraints or implementation risks, a growing range of flexible funding models and staged delivery strategies can help ease the transition. Selecting the right commercial approach is often as important as choosing the right technology.

Funding Models: Capex and beyond

Automation projects can be funded in several ways, each with its own impact on cashflow, ownership, and long-term cost. Selecting the right financial model is a key part of reducing risk and ensuring sustainability.

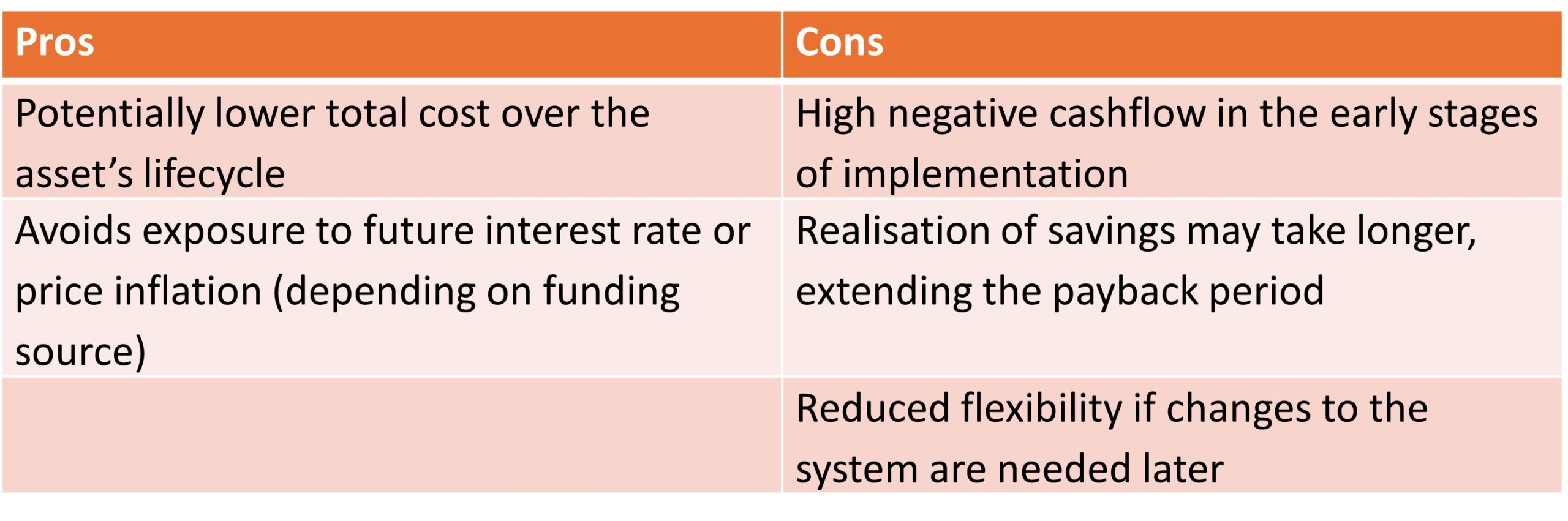

1. Traditional Capital Expenditure (Capex)

This model involves purchasing automation assets outright using company funds or internal financing. It typically requires significant upfront investment but results in full ownership of the equipment, with potential long-term cost benefits.

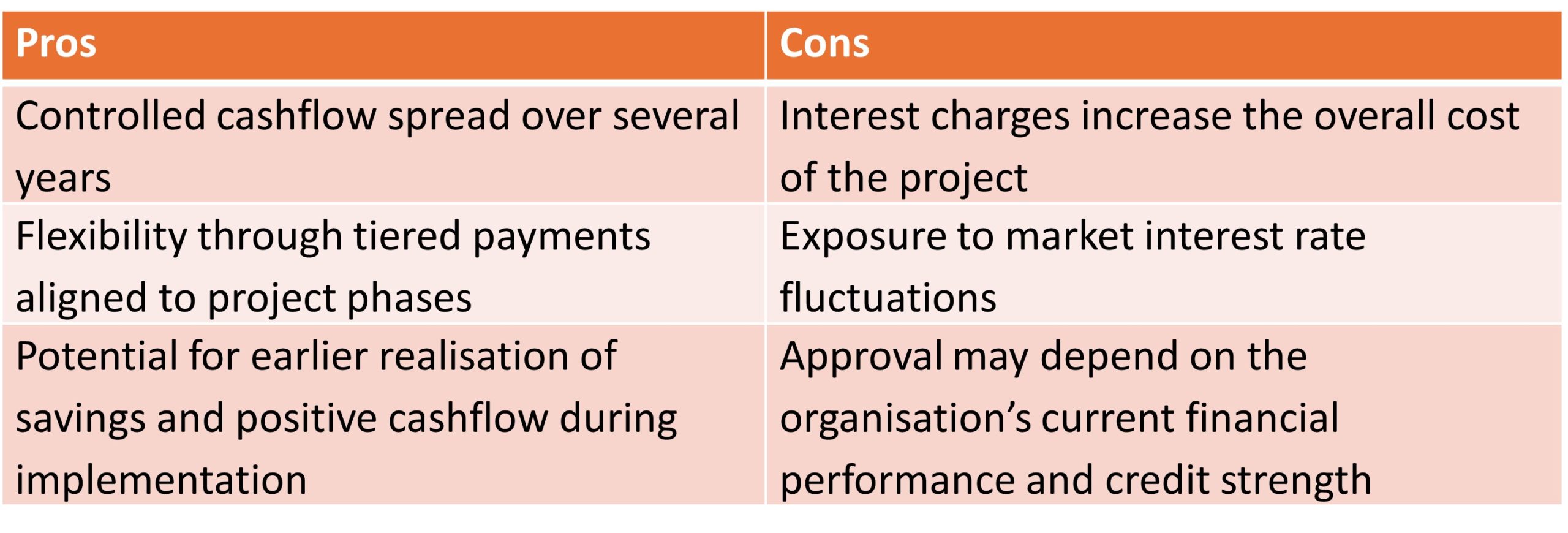

2. Third-Party Finance / Supplier-Led Payment Agreements

This approach allows businesses to spread the cost of automation over time, using finance provided by external lenders or payment terms structured by suppliers. Payments are often staged based on milestones, reducing the upfront burden while incurring interest.

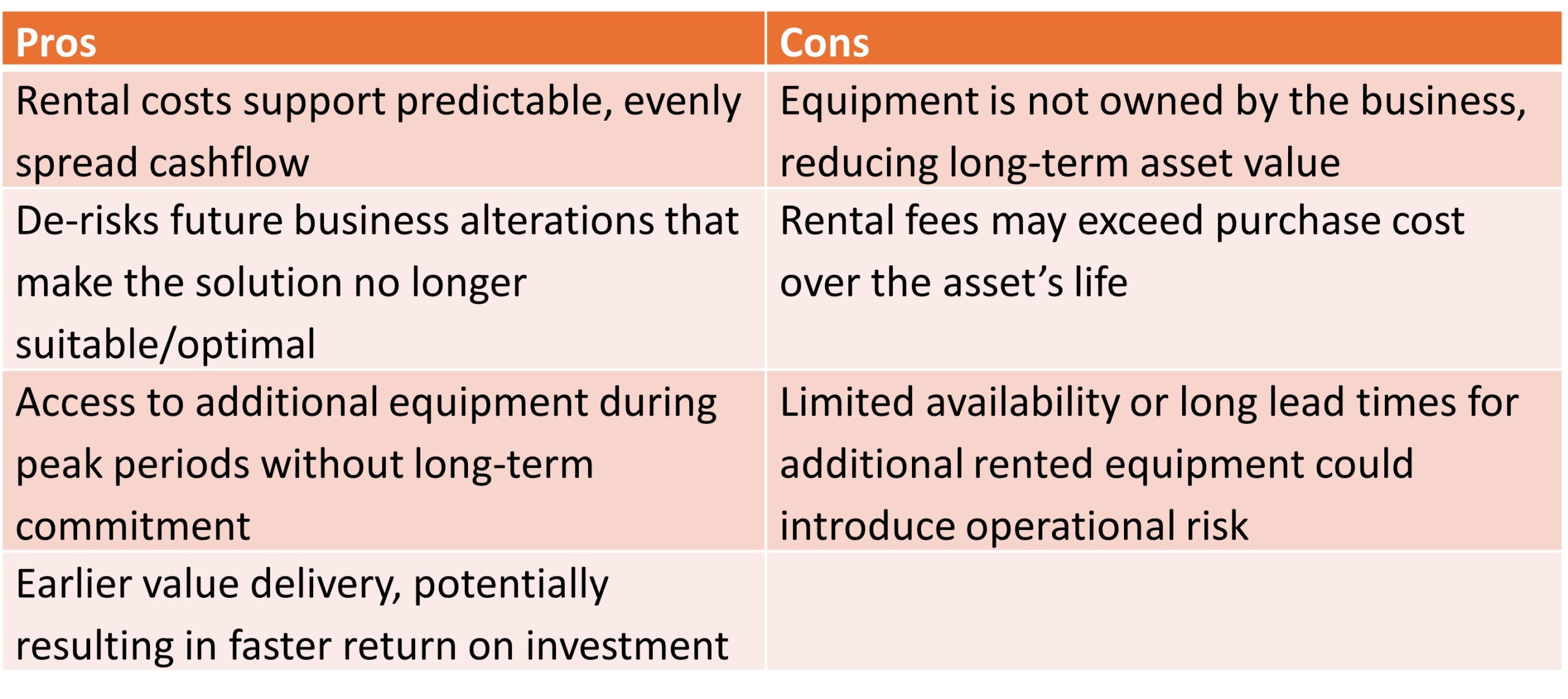

3. Provider Rentals / Automation-as-a-Service

Under this model, automation assets are rented or leased, either on a short-term basis or as part of an ongoing service agreement. This eliminates upfront ownership costs and provides greater operational flexibility, though often at a higher overall price.

Phased and Modular Rollouts

Rather than committing to a large, single-stage project, many businesses are choosing phased or modular rollouts. By targeting high-impact areas first, such as order picking, palletising, or intralogistics, organisations can build a foundation for further automation while demonstrating early return on investment (ROI).

This approach not only spreads the financial and operational load but also gives teams time to adapt to new workflows, technologies, and roles. It creates space for learning and course correction without compromising business continuity.

Strategic Use of Consultants and Systems Integrators

Involving independent consultants alongside integrators can significantly reduce the risk of scope creep, misalignment, or underperformance. These partners bring cross-sector experience, an external perspective, and the technical rigour needed to translate operational needs into automation requirements.

From feasibility studies and business case development to solution design, supplier selection, and full implementation, consultants can act as impartial advisors and experts, ensuring that automation is fit for purpose, scalable, and aligned to strategic goals.

Proof of Concept, Feasibility Studies and ROI Modelling

Launching a pilot or proof-of-concept in a controlled environment allows companies to test assumptions, quantify benefits, and secure stakeholder buy-in before committing to a full-scale rollout.

Paired with robust ROI modelling, accounting for not just cost and productivity, but also risk, flexibility, and resilience, this helps build confidence at board level and creates a solid foundation for further investment.

Conclusion: Enabling Confidence in the First Step

Automation is no longer the preserve of global giants with bottomless budgets. Advances in technology, commercial flexibility, and implementation strategy now mean that mid-sized and even smaller enterprises can access automation on their own terms.

For businesses held back by Capex constraints or nervous about operational risks, the key is to start small, think strategically, and avoid going it alone. Whether through finance-led models, phased rollouts, or expert consultancy, there are multiple paths to automation that balance ambition with caution.

In short, automation doesn’t have to be a leap, it can be a series of well-planned steps. And for those ready to take the first one, the rewards can be transformative.

Contact us for more information on our Warehouse Automation services.

Ideas & Insights

Sharing Our Expertise

Our guides, ideas and views. Explore our insights to deliver tangible improvements to your supply chain and logistics operations.