Article

Preparing Your Supply Chains for the Logistics of Brexit

Preparing your supply chains for the logistics of Brexit

With many businesses still reeling from the impact of COVID 19 on their supply chains and their business, there’s another major wave coming on the horizon – Brexit.

Production planning and lead times mean many businesses can’t afford to take chances – importers and exporters need to take action now to prepare for the worst say Simon Dixon, Founder & CEO of supply chain and logistics advisors, Hatmill, and Craig Poole, Managing Director of logistics provider, Cardinal.

The Government still plans to introduce import controls on EU goods at the border after the transition period ends on 31 December 2020.

This will mean ‘traders in the EU and GB will have to submit customs declarations and be liable to goods checks’. Do not underestimate what’s involved in terms of compliance and paperwork, or the knock-on impact this will have on your supply chain and stock management.

Pre-COVID the Government stated that any ‘policy easements’ for a potential no deal Brexit, such as extra time to pay VAT, will not be reintroduced as they believed businesses had adequate time to prepare. Who knows whether this will stick too, but our advice is assume that it will.

So, the message is clear, if you’re an importer or exporter, then you must take immediate action to continue trading after 31 December 2020, and prepare for the impact on your supply chain. Here we explain what’s going to happen, the action you need to take, and the impact this may have on your business.

The logistics – what we know so far

- From 01/01/2021, Goods coming to the UK from the EU will face import controls at the port of entry

- Customs Duty / VAT may have to be paid

- Importers in the UK will need to register for an EORI (Economic Operators Registration and Identification) to trade with the EU

- Tariffs will apply to goods moving across the border from the UK to EU and vice versa, subject to discussions between the UK and EU

- Commercial documentation, such as Commercial Invoices, will need to be raised for Customs Declarations

The admin – what you need to do now (even if we don’t know all the detail yet)

- Decide whether you will handle Customs Declarations in-house or through a 3rd party

- Check if you are eligible for Simplified Customs Procedures

- Check for updates to tariffs that apply to your goods and consider using duty relief schemes

- Confirm if you need licences or certificates to bring goods across the border

- Ensure any drivers involved in transportation are aware of documentation required at the border

- Register for AEO (Authorised Economic Operator) status. AEO gives ‘trusted trader status’ and is internationally recognised

Outsourcing customs procedures to a 3rd party Customs Bureau

Benefits of CFSP to Importers;

- Cash flow benefits for importers

- Accelerated release of goods

- Better visibility and control of customs data

How will this impact your business

We know that there are going to be knock-on impacts, so you need to plan now and minimise disruption to your supply chain. The controls, checks, processes and procedures that take effect after the 31 December 2020 are likely to add at least a day, and potentially more than a week, onto lead times, so it’s time to think about how you’ll build in extra flexibility so your business can cope with the disruption and additional lead-time as a new norm Another key consideration is your pricing policy. New import controls might increase your administration and warehousing costs, but it's essential to get advice and plan now for how duty imposed on imports might affect the end-price of your product. And this is not as simple as it sounds.Key questions you need to consider

- Review your stock management and ordering parameters – How are you going to account for lead time volatility?

- How will this affect your stock holding requirements?

- Will you need to change stock locations to maintain order fulfilment times to your customers?

- Will you need to split stock? If so, how will you do it?

- What is your forecast warehouse capacity, relative to additional stocks?

- What is your plan to collaborate with other businesses in your supply chain to mitigate these additional costs and delays?

- Do you have the resources in your business to cope with additional administration and supply chain management?

- How are you going to brief your operation to prepare them for the impending changes?

Making your customs declarations

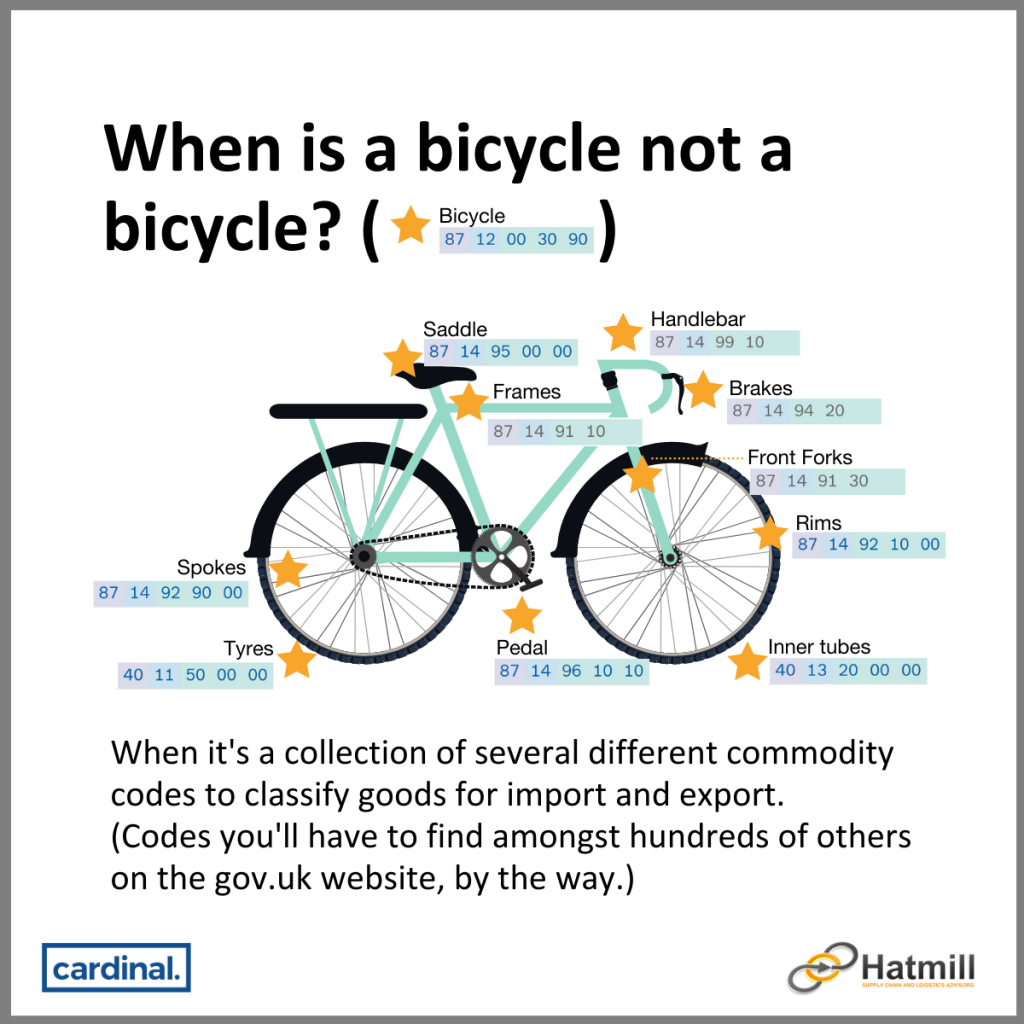

You’ll need a commodity code for your product to make your customs declaration when you bring goods in or send goods out of the UK or EU. This includes goods dispatched to you from abroad. To do this you’ll need to classify your goods correctly to know what rate of duty and import VAT you should pay. So, let's say you're importing bicycles. There's not one code for a bicycle. Instead, there's a code for each part, e.g. rubber inner tubes, another one for rubber tyres. So, one product is a collection of codes that you’ll need to find on the gov.uk website – one product could be 6 or 7 different codes, or more. Based on this, HMRC will tell you what the duty is.Do not underestimate what's involved in terms of compliance and paperwork, or the knock-on impact this will have on your supply chain and stock management.

So, in summary:

- Importers and exporters need to prepare now

- The Government believes that businesses have enough time to prepare and there won’t be any policy easements

- Don’t underestimate the amount of work involved and don’t be tempted to put it off

- Assume there will be delays and disruption to supply chains, and take immediate action to put contingency plans in place

- Seek advice about preparing your supply chain and fulfilling your customs paperwork

More about Cardinal

Cardinal provides a wide range of services including:

- UK import/export customs declarations

- EU import/export customs declarations

- Customs transit documentation

- Deferment Account

- CFSP

- Complete customs compliance health checks

- Customs classification review and support

- Customs documentation support

- BTI applications

- Customs regimes – both applications and management for Warehousing, IPR, CFSP

- Duty reclaims

Please email craig.poole@cardinal.co.uk or visit cardinal.co.uk

Ideas & Insights

Sharing Our Expertise

Our guides, ideas and views. Explore our insights to deliver tangible improvements to your supply chain and logistics operations.