Article

Warehouse Automation: Building a Strong Business Case for Efficiency

Key Costs and Benefits of Automation

Warehouse Automation is no longer a luxury; it’s necessary to drive efficiency and productivity. A robust financial business case for an automation project is essential to justify the investment.

A comprehensive financial business case balances costs and benefits. Producing one can be challenging, especially for smaller businesses that lack the resources and expertise to build such models.

Here, we summarise the essential inputs needed to build a compelling business case and demonstrate the financial metrics as outputs.

There should always be a base position of ‘do nothing’ from which you will derive the costs associated with not doing your project. For example, missed sales or being tied into a building lease contract.

After your ‘do nothing’ scenario, you should consider four key costs:

- CAPEX – one-off spend that results in an asset that will depreciate on your net book value, such as the purchase of a refrigeration unit

- REVEX – one-off spend after which no asset is owned, such as the team that installs the refrigeration unit

- Ongoing annual costs that will increase each year with inflation, such as maintenance costs. These are fixed costs independent of throughput volume

- Ongoing annual benefits that will increase each year with inflation, such as improved warehouse productivity benefit as a result of automation. These are variable costs dependent on throughput volume

CAPEX

- Automation – this could be a one-off spend or a lease option over several years

- Building Infrastructure – changes such as new dock doors, racking or conveyors

- IT Infrastructure

REVEX

Often, REVEX costs are capitalised to obtain cash sign-off. However, no asset will be owned afterward.

- Dilapidation Costs – the costs of restoring leased properties to their original state

- Asset Write-off – any obsolete assets that the automation technology replaces

- VR and PILON – automation may lead to FTE reductions. Costs for VR (voluntary redundancy) packages and PILON (pay-in-lieu-of notice) for affected employees must be included

- Project Resource – (internal and external) needed to implement the automation project

- Operational Disruption – usually a bell curve of UPH (units per hour) degradation converted into a weekly cost for the duration of implementation

- Stock Migration

- Training Costs

Ongoing Annual Costs

- Management Structure – your project may increase or decrease your management headcount

- Building Leases and Utilities – these could be positive or negative depending on whether your property footprint is increasing or decreasing

- Engineering Maintenance, Spares and end-of-life replacement parts

Ongoing Annual Benefits

- Operational Productivity Benefit – warehouse productivity improvement and reduced OPEX. Future FTEs (full time equivalent) can be calculated here too

- Stock accuracy

- Picking accuracy

- Accidents and claims

Outputs and Metrics

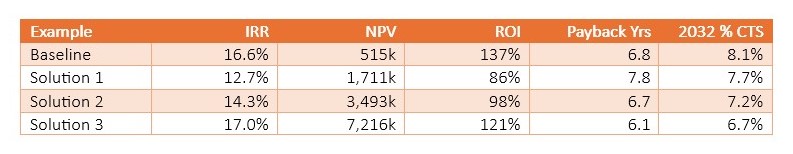

Different businesses like different metrics as their measure of success. Once you’ve compiled the inputs, the following financial outputs show the viability of the project:

- Internal Rate of Return (IRR) – like a bank’s interest rate, if you invest in this project, this is the equivalent interest rate you’d get on your investment. A rate greater than 10% is a solid return. Greater than 25% is exceptional

- Net Present Value (NPV) – a bit of an abstract notion, NPV calculates the value of future cash flows back to present value. A positive NPV is good as it suggests the project will increase the value of your investment

- Return on Investment (ROI) – a straightforward metric indicating the percentage return on the investment

- Payback Period – the time it will take for the project to repay its initial investment

- Future % Cost to Serve – the future logistics costs divided by the future business’s revenue. % CTS is an excellent measure of how efficient your logistics network is at servicing the business. ~3.5% is considered best in class

Conclusion

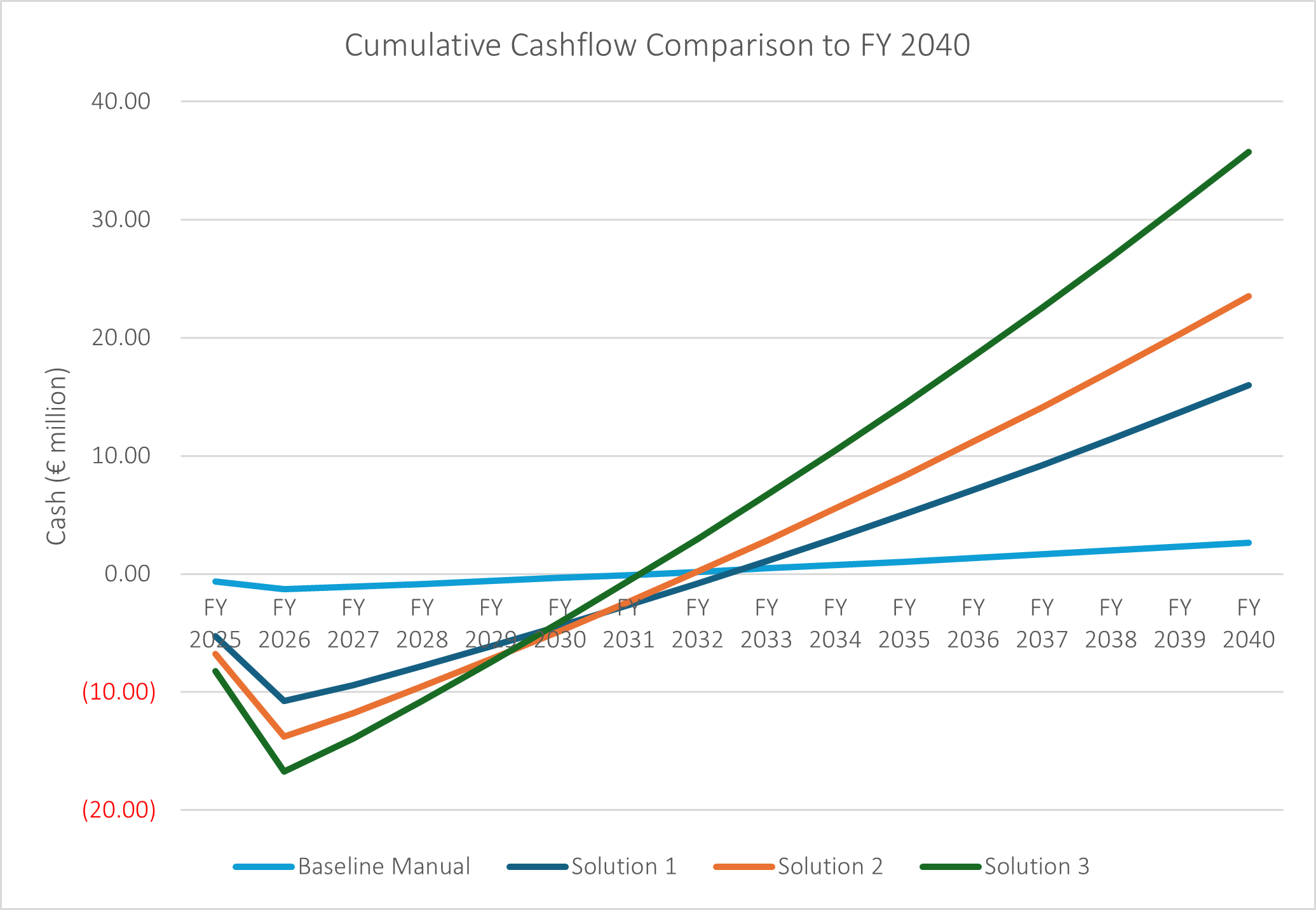

Your project is likely to have a lifespan of 15 to 25 years. Over that time, the cumulative cashflow that your warehouse automation project has generated creates a “Nike swoosh”-shaped graph. The end of the swoosh shows the size of the prize and your lasting legacy on the business.

In conclusion, automation is a transformative journey that can redefine your business’s future. By crafting a solid financial business case, you set the stage for substantial returns. From enhanced productivity to significant cost savings, the benefits are clear. Key metrics like IRR, NPV, ROI, and Payback Period will guide you to making the right decision.

Ideas & Insights

Sharing Our Expertise

Our guides, ideas and views. Explore our insights to deliver tangible improvements to your supply chain and logistics operations.